Columbia Bank vs. Lake Shore Hospital Authority Bid Protest About More Than Money

Posted March 14, 2019 08:50 am

COLUMBIA COUNTY, FL – Monday night, March 11, 2019, as the Lake Shore Hospital Authority ramped up for its evening meeting, Columbia Bank employees and supporters overflowed into the lobby: on the agenda, a bid protest by Columbia Bank - the "hometown" bank. One of the major problems: neither the Authority procurement policy, nor the Request For Proposal (RFP) had any instructions for protesting the bids.

Background: Columbia Bank

Columbia Bank is a true "hometown" bank. Begun in 1911 in Lake City, it remained exclusively a Lake City/Columbia County bank until 2017 when it planned offices in Gainesville and Ocala. These offices are now open.

During the mortgage crisis, Columbia Bank got caught short on reserves. A local infusion of cash kept the bank operating.

Most of Columbia Bank's deposits come from the Lake City/Columbia County area, which is also where most of its loans are made.

LSHA deposits totaled more than $14 mil in Columbia Bank before the RFP was advertised. This amounted to 8% of the bank's deposit base, reserves of which are used as a basis to lend money back to the community.

Columbia Bank Attorney Joel Foreman, with a

court reporter by his side, addresses the

Authority Board, as Columbia Bank employees,

board members, and members of the public look

on.

Background: Lake Shore Hospital Authority

In 1955 the Florida Legislature established the Lake Shore Hospital District; in 1963 the Lake Shore Hospital Authority was established by the FL legislature; in 2005 the legislature re-codified the Authority's enabling legislation.

The Hospital had different operators over the course of time and in 2003 the lease was assigned to "Shands at Lake Shore," the same Shands one sees in Gainesville, now known as UF Health Shands Hospital.

UF had established a health clinic in Columbia County and there were opportunities for residency programs and other training opportunities in the Lake City/Columbia County community. The Authority Board ignored these opportunities.

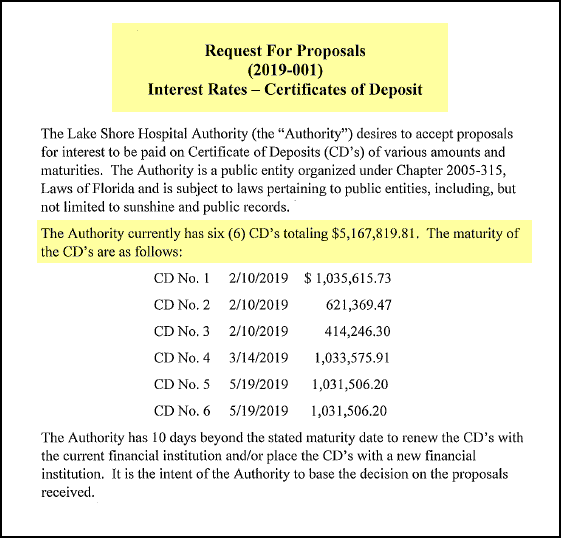

The list of CD's that were being

re-financed through the RFP. It is not easy to

find them in the recommendation. +Enlarge

Those opportunities and others were squandered through foolish land acquisitions in downtown Lake City, a move spearheaded by the then Chairman of the Authority, Jackson P. "Jack" Berry.

Bleeding money, the lease was reassigned from Shands in 2010, which left the Authority where it is now, leasing the Hospital to by some measures the largest for profit hospital operator in the country, Community Health Systems (CHS).

Known as Shands at Lake Shore, the hospital is not a "community" hospital, it is a for profit hospital located in the community.

The republican governor appointed board is in the process of funneling millions into projects at the hospital for which CHS is required to pay.

The Money

Authority Board Chairman Brandon Beil. He was

not doing a lot of smiling during the

discussion.

Columbia Bank has been the depository of LSHA funds for quite some time. The Observer has records going back to 2014, which show $7.17 mil in Columbia Bank; by February 2019, the deposit amount rose to $14 mil.

On January 14, 2019, Authority Manager Dale Williams "explained his request to solicit interest proposals regarding maturing CD's held by the Authority." (LSHA minutes)

On January 23, 2019, LSHA Board attorney, Fred Koberlein, Jr., "reviewed a draft of RFP [Request for Proposals] for CDs." The review cost the Authority $135. Mr. Koberlein did not reveal the provider of the RFP.

If Attorney Koberlein found anything wrong with

the RFP after his review, he wasn't talking.

On January 25, 2019, the RFP was finalized. The return date was February 1, 2019. The RFP listed the six CD's for which rates were being requested.

An undated addition to the information regarding the RFP was added. It is not clear when the document was added. As is endemic in Columbia County, the document is not dated. The document referred the expiration dates of three of the CD's.

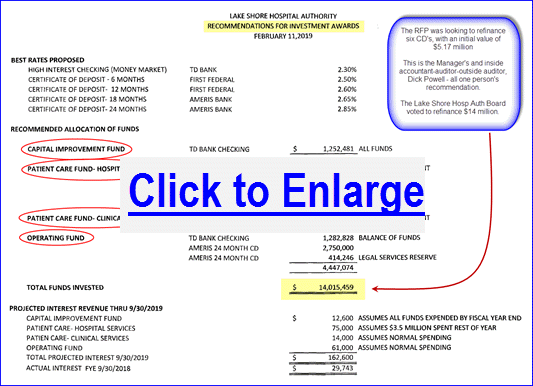

The RFP was clear and specific, six CD's totaling $5,167,819.81 were on the table, period. (see list of CD's above)

The Award: February 11

On Feb. 1, 2019, Manager Williams tabulated the proposals and forwarded his tabulation to the Board. He made no recommendations at that time.

He pointed out that First Federal submitted the "best renewal rates for short term CD's" and "Ameris Bank submitted the best renewal rate for long term CD's."

The Dale Williams Dick Powell recommendation.

Finding the CD's in the RFP is problematic.

On February 8, Manager Williams finalized his "Award Recommendation – Cash Investments (CD's)." It is not clear if he emailed his recommendations to the Board members or if they had them prior to the February 11 meeting.

During the February 11, 2019 LSHA Board meeting, Manager Williams presented the RFP and his recommendations publically for the first time. This information was not available on the internet prior to the meeting. It still is not.

During the February meeting, Columbia Bank President David Bridgeman and Lake City Market President Lori Simpson appeared and offered to raise the bank's rates, a point on which the LSHA de minimis minutes are silent.

What went on before the vote: February 11, 2019

Mr. Bridgeman: "I am just a few minutes down

the road... We may not be quite as high as

everybody, but we're not far off - very close.

We know that because of the relationship, what

we can do for you, and the fact that you won't

have to move anything is very, very important...

We would really like for you to consider staying

with Columbia Bank, because we're your bank. We

have been that for a long, long time and we want

to remain that way."

Ms. Simpson: "Unfortunately, we weren't

the top bidder, but a close second and third in

most cases... We hope that the yields aren't the

only thing that matters. Certainly the service

and the fact that we are a community bank plays

in. We try to make it easy for our customers to

bank with us."

Ms. Simpson added that in October the bank

raised its interest rates on its own, "without

the Authority having to come to the bank."

Manager Williams: "What we've done in

our recommendation (this includes Dick Powell)

is we made - pretty much made it on the basis of

maximizing return on investment and that was the

only consideration. We did not weigh service; we

did not weigh community good will; it was simply

based on return on investment."

Board Attorney Koberlein said that the Board "could use

other determining factors, as long as you find

the bidder responsible."

Board member Thompson: (Made motion) "Based

on the fact that this was a fair and competitive

process and that everybody had knowledge to what

our goals were, that we accept the allocation

and distribution as recommended by Mr. Williams

and agreed to by Mr. Powell."

This was the motion. It is not in the minutes

as moved.

Board member Jay Swisher: (without

hesitation) "I second."

Following Board discussion, Mr. Bridgman made a

quick calculation, and told the Board the net

difference between Columbia Bank and the others

was $22k.

Board member Janet Creel pointed out

that the change over would not be simple.

Ms. Simpson Told the board that that Columbia

Bank could up its interest on the money market

account, which was not in the RFP, "We could

very easily go to 2.3%. We'll say right now

we'll do 2.3 on the money market, if that makes

a difference."

Board member Thompson was not keen on the

idea.

Chairman Biel called for the vote (the chair

does not vote). Mr. Thompson and Mr. Swisher in

favor, Ms. Creel opposed.

The Board ignored the Columbia Bank offer.

Just One Giant Screw Up

Board member Janet Creel and Manager Williams

did not look happy during the proceedings.

The law requires "Any person who is adversely affected by the agency decision or intended decision shall file with the agency a notice of protest in writing within 72 hours after the posting of the notice of decision or intended decision."

While Columbia Bank notified the Authority of its intent to protest the award, the Authority never posted "the notice of decision or intended decision," unless one counts the board minutes of Feb. 11, which may or may not be what was intended by the law and additionally, it is unclear when those minutes made their way to the Authority website.

The RFP only called for the award of CDs and not money market funds.

The Board voted to reallocate all $14 mil on account in Columbia Bank, millions of which were in money market accounts.

Columbia Bank made a bid protest.

Not counting the fees by Manager Williams and Richard Powell, the fees clocked by Board Attorney Koberlein, Jr. on this issue through February 25 are $2,280.

It is clear that the Columbia Bank attorney fees are well over that.

The Next Step: What is fair to the public?

There are options: Columbia Bank and the Authority could negotiate, jacking up more fees for both the bank and the Authority, whose primary purpose is to provide indigent care for the needy in Columbia County.

The Board could hold a special meeting and possibly throw out all the bids. This is dangerous, because the successful bidders could sue and claim that they responded in good faith and complied with the RFP.

Of course the Authority Board could "man/woman up" and admit that the RFP and the recommendation was so screwed up that it was just not fair to anybody; throw out the bids; and start all over again.

After looking at all the facts, it is doubtful that any court, or anybody else, would disagree with that plain English conclusion.